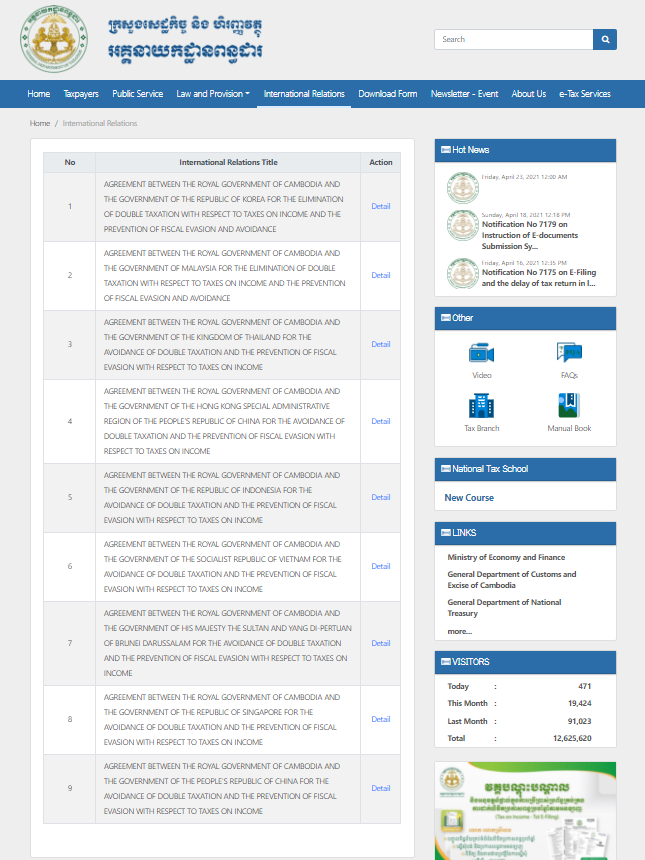

On the General Department of Taxation (GDT) of the Kingdom of Cambodia listed down 9 countries under the international relations tab where the Double Taxation Agreement (DTA) is signed including:

- The Elimination of Double Taxation agreement between Cambodia and Republic of Korea

- The Elimination of Double Taxation agreement between Cambodia and Malaysia

- The Avoidance of Double Taxation and Prevention between Cambodia and Thailand

- The Avoidance of Double Taxation agreement between Cambodia and Hong Kong

- The Avoidance of Double Taxation agreement between Cambodia and Indonesia

- The Avoidance of Double Taxation agreement between Cambodia and Indonesia

- The Avoidance of Double Taxation agreement between Cambodia and Brunei Darussalam

- The Avoidance of Double Taxation agreement between Cambodia and Singapore

- The Avoidance of Double Taxation agreement between Cambodia and China

Source: Cambodian Department of Taxation

Other than that business activities including online earning may fall under certain tax cut to countries where there is no tax agreement.

Another enlightening resources found for the Agreement between the government of the United States of America and the Royal Government of Cambodia to Improve International Tax Compliance and to Implement FATCA can be read here.

Please make sure to check from the country tax office for any further update of taxation and agreement of tax treaties among each country.

* For business owners or investors who are looking for a professional translator to translate your documents from English to Khmer or Vise Versa, you can reach to us or Hire Us Online Here.